We can not escape volatility but we can escape the inflation narrative

The global economy is a Möbius strip

The new inflation data reading was 9.1%! Inflation is the dominant narrative….

While there is still stress in supply chains, the trend is improving.

Container prices are decreasing

Many commodities are correcting

Oil was the last man standing, now those prices are correcting as well

Oil YoY is an inflation leading indicator.

Wait a minute - in the 1970s the US was energy dependent.

The US is now a net exporter of energy. In 2011, 60 billion dollars flowed monthly to offshore systems. Now, there withdrawals total 6 billion dollars each month. That means offshore US Dollars are scarce.

A strong USD is not consistent with the stagflation narrative

Trapped inside the Möbius strip

The problem of basing our decision process on the inflation data or other one dimensional time series is that it is difficult to understand the macro context. We are like ants trapped inside a Möbius strip waiting for the next round of inflation data or the next signal from the FED.

This map helps me to escape the Möbius strip

We are living in a multipolar world.. One that is fierce with competition. Five main blocks - US, Europe, India, China and Japan and Korea are competing for energy, technology, natural resources, geopolitical power and also for reserve currency status.

In the map, Russia and East Europe seem under a lot of pressure from the new geopolitical architecture.

Brazil looks resilient to the gravity forces of the multipolar powers.

In a world with intense competition we have to be long in what is scarce, which are commodities and technology and be short in what is structurally abundant: DEBT

Diversification is not enough because of disruption of the supply chains.

What does it mean for equity markets?

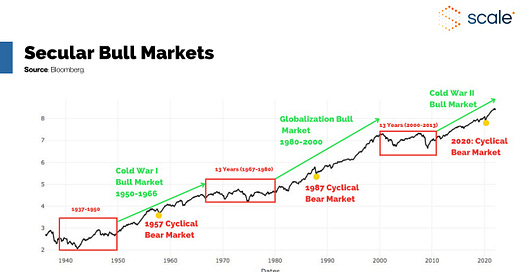

Periods of intense competition for technology triggers increases in productivity. That is a very important driver of the secular bull market in equities.

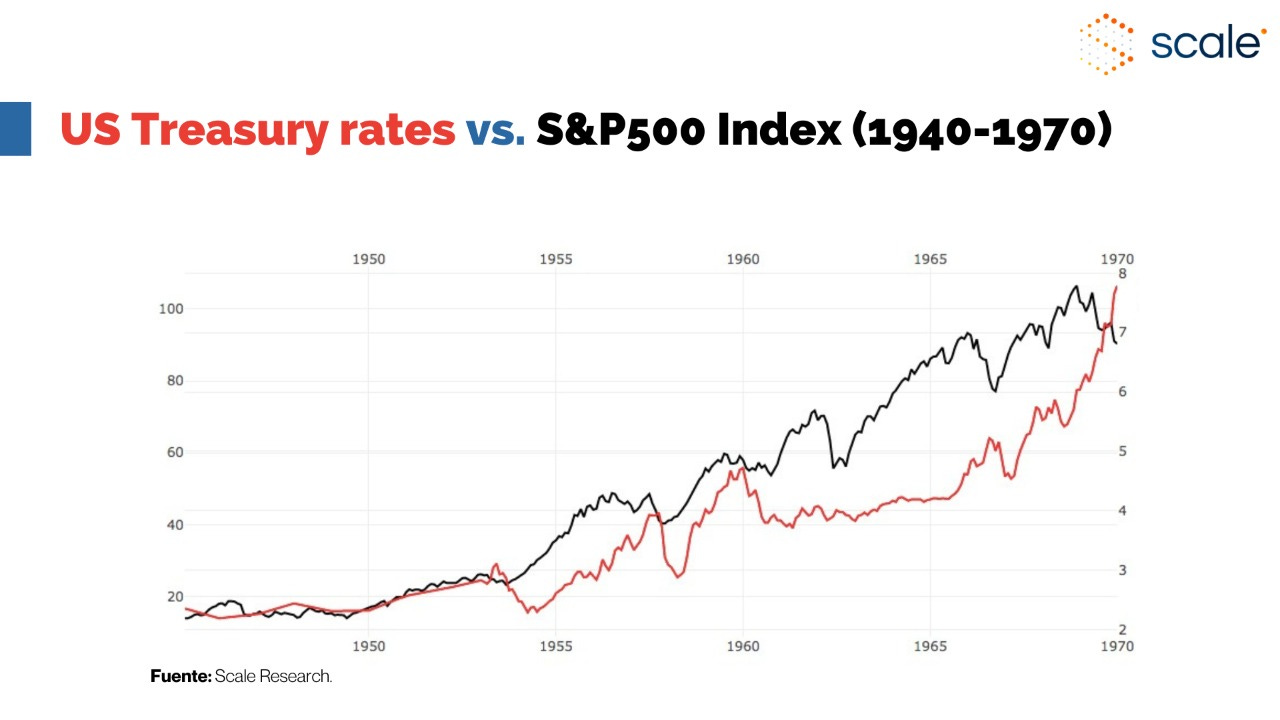

The proxy is not the 70s, but instead the 50s

The Cold War was remarkably positive for equities and commodities. It was terrible for treasuries.

I hope this newsletter helps to connect the dots.

Thanks for reading,

Guillermo Valencia A

Co-founder Scale & Macrowise

Brazil