What Is Money or Value? From a Scoring System to Evolution.

The most misunderstood aspect of Darwin’s theory is the idea that survival hinges on competition. In reality, survival depends on connectivity.

Money is one of humanity's oldest tools—yet it remains one of the most misunderstood. To truly grasp its essence, we must see it not as a static entity but as a dynamic system deeply embedded in the networks that drive human progress. From Raoul Pal's conception of money as a scoring system, to Charles Gave's critique of fragmented monetary theories, to Satoshi Nakamoto's revolutionary Bitcoin framework, we find recurring themes: connectivity, trust, and evolution.

The Game of Money

Raoul Pal, founder of Real Vision, describes money as a "scoring system," an elegant metaphor for its role in our lives. Money is not the goal but the enabler—a way to access freedom, deepen relationships, and create memorable experiences. It acts as points in a game, but the objective isn't to "win" by hoarding wealth. Instead, it's about using those points to unlock new opportunities, foster creativity, and make meaningful contributions to the world.

Money, in this sense, is a tool for leveling up. It allows individuals to break free from survival-mode constraints, explore their potential, and engage with others. But if the game becomes about scoring for its own sake, we lose sight of the larger purpose: to enrich life, not just accounts.

The Blind Men and the Elephant

Charles Gave, founder of Gavekal Research, critiques modern economic theories in his essay, The Blind Men Looking at Money, highlighting their failure to see the full picture. Economists often treat money as a store of value, a medium of exchange, or a unit of account—isolated components of a greater whole. This fragmented understanding leads to flawed policies, such as excessive quantitative easing or misguided interest rate manipulations.

Gave’s central point is that money’s true purpose lies in trust and connectivity. Historically, money evolved to facilitate trade, build networks of collaboration, and enable growth. When trust in money erodes—through inflation, overprinting, or central bank overreach—societal stability suffers. The solution, he argues, is a holistic understanding of money’s multifaceted role in creating sustainable networks of value.

Nakamoto’s Revolution

Satoshi Nakamoto’s Bitcoin represents a radical rethinking of money. By removing reliance on central authorities, Bitcoin decentralizes trust through cryptographic proof and blockchain consensus. It embodies scarcity, limiting its supply to 21 million coins, and serves as "digital gold," immune to inflationary pressures of fiat systems.

Nakamoto’s vision aligns with the concept of money as a tool for freedom. Bitcoin provides access to financial systems for billions excluded by traditional banking. It’s not just about decentralization; it’s about sovereignty—empowering individuals to operate within a trustless network where value is preserved without intermediaries.

Evolution as Connectivity

In my opinion, money is best understood through the lens of evolution. The most misunderstood aspect of Darwin’s theory is the idea that survival hinges on competition. In reality, survival depends on connectivity—the ability to form networks that bridge information, matter, and energy. Marsupials triumphed over dinosaurs because they adapted to connect with diverse ecological networks, and mammals later formed the social and cultural systems that define human dominance.

Evolution, then, is not about winning—it’s about creating new networks. When the networks of countries, cities, or individuals stop growing, they stagnate. Crises arise when we fail to interconnect existing systems with emerging ones.

Money as a Network Interface

Money acts as an interface between networks. It’s like an icon on a desktop: a simplified representation of complex underlying systems. Debt, for example, isn’t inherently bad. It’s a mechanism to sacrifice the stability of current networks in order to build future ones. When used properly, debt enables interconnectivity and growth. When mismanaged, it signals a breakdown in network functionality.

Artificial intelligence is creating entirely new production systems, redefining connectivity across industries. Many commodity-exporting emerging markets, including Brazil, face similar challenges in evolving their production models. Brazil is burdened with debt but lacks a radical transformation in its economic structure. This differential signals potential currency crises not only in Brazil but across other resource-dependent economies.

USDBRL. New potencial crisis in Latam.

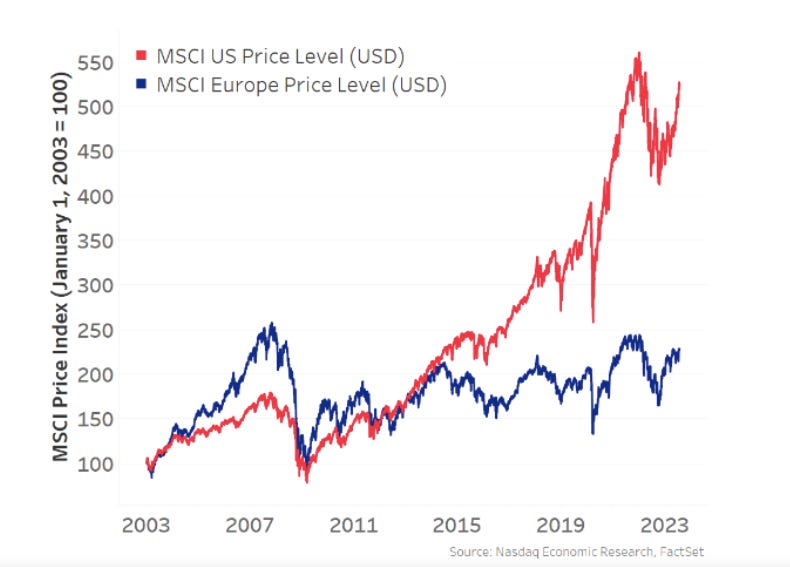

Europe, too, faces critical challenges. With significant energy dependencies and limited leadership in the AI revolution, the continent risks falling behind in building the networks necessary for future growth. These vulnerabilities expose a broader systemic issue: economies that fail to innovate and interconnect stagnate, becoming fragile in the face of global shifts.

Criticism of U.S. Exceptionalism and the Rise of New Networks

Critics argue that U.S. exceptionalism is overstated, noting that excluding NVIDIA’s performance would make the S&P 500 resemble European indexes. But this perspective misses the forest for the trees. NVIDIA is not just an outlier; it’s the cornerstone of a new network—a new system of production. Money’s true value lies in its ability to create and sustain such networks.

Consider this: Apple, with over 1,3 billion users, commands a valuation of $3 trillion. Google’s vast user base underpins its market dominance. Microsoft, through its ecosystem of Office, Azure, and LinkedIn, connects billions of users and businesses worldwide, creating a lattice of productivity and data networks. Meta, despite controversies, connects nearly 3 billion people through its platforms, facilitating social and economic exchanges on an unprecedented scale. Amazon’s network is built on billions of transactions, supported by its e-commerce platform and AWS cloud infrastructure, which underpins the digital economy.

These companies represent more than just their valuations. They embody networks of connectivity—vast ecosystems where users, data, and transactions intersect to create unparalleled value. NVIDIA, as the backbone of AI innovation, signals the emergence of a transformative network. The question isn’t about NVIDIA’s current valuation; it’s about identifying the other players necessary for this network to grow.

The New Network Builders

Value in the future will depend on connectivity within emerging networks. Companies like TSMC, Tesla, Broadcom, and Palantir will be critical nodes in the new system of production. Palantir, with its ability to integrate and analyze vast datasets, plays a key role in optimizing these networks by transforming raw data into actionable intelligence, enabling governments and businesses to operate more efficiently within complex ecosystems.

Systems like Bitcoin and Web 3.0 represent the infrastructure of decentralized finance, while AI and advanced semiconductors form the technological backbone.

Value in the future will depend on connectivity within emerging networks. Companies like TSMC, Tesla, and Broadcom will be critical nodes in the new system of production. Systems like Bitcoin and Web 3.0 represent the infrastructure of decentralized finance, while AI and advanced semiconductors form the technological backbone.

Money, then, is not just a measure of wealth. It’s the ability to create, sustain, and expand networks. As new systems of production emerge, those who understand and align with these networks will shape the future of value.

Conclusion

Money, at its core, is not about accumulation but transformation. It’s the tool that bridges past networks to future possibilities. From Raoul Pal’s game metaphor to Charles Gave’s holistic critique, to Satoshi Nakamoto’s decentralized vision, one truth emerges: money’s essence lies in connectivity.

In the age of AI and decentralized systems, the new currency of value is not just capital but network connectivity. The future belongs to those who can harness these networks, creating value not by competing, but by connecting.

Merry Christmas!

Guillermo Valencia A

Cofounder of Macrowise

Medellín Colombia

December 21st , 2024

Palantir, with its ability to integrate and analyze vast datasets, plays a key role in optimizing these networks by transforming raw data into actionable intelligence, enabling governments and businesses to operate more efficiently within complex ecosystems.

AAPL, MSFT, GOOGL, AMZN, META…embody networks of connectivity—vast ecosystems where users, data, and transactions intersect to create unparalleled value.