Distortion makes it more difficult to make a decision

Current analytic frameworks cannot be more contradictory. Full employment, PMI at levels above 50, Powell Quantitative Tightening hesitation.

We have crossed over from coordination panic in December to coordinated euphoria in the first quarter in almost every asset class.

What is the signal and what is noise?

Two things have been the key drivers for the markets recently: the uncertainty of Powell and the procrastination of the trade deal.

The problem is that there is a lot of distortion in the US and the Chinese data is like a black box, where the data is not entirely trustworthy and every analyst has a different, speculative stake.

The animal spirits have been working furiously to trying to answer if the party will continue like it’s 1999 or if the music is about to stop? Here is our noise vs. signal checklist.

Microsoft Vs. Google (MSFT, GOOGL), Oil, High Yield Zombies (HYG, LQD), Australia is reminiscent of 2008 (WBK,CBA, ANZ, NAB)

Riding the bubble: Microsoft Vs Google

Noise: The first expression of liquidity in global markets has led to a strong rebound in the FAANG stocks. They have had a very strong performance, but persisting fears of a bubble make it difficult to overweight stocks.

Signal: Timing when a bubble will burst is obviously a difficult job. However, there are certain things about bubbles that we can exploit in a trade. Before a bubble bursts, it plays out like a monopoly game: winner take all. One of the winners we see in this game is Microsoft and one of the losers is Google. Google is a great company, although new antitrust and privacy protection legislation makes them more vulnerable than Microsoft. Since April 2017, MSFT has outperformed GOOGL considerably.

Source: Stockchart. MSFT Vs GOOGL.

OIL: Libya and Venezuela Vs US Shale Oil Production

Noise: Oil prices continue to rally, driven by the news of escalating conflict in Libya, minimum production levels in Venezuela and OPEC’s commitment to cut production.

Signal: The US shale oil production is at record levels, topping more than 12 million barrels per day. The average operating costs per barrel is about $31.80 US, based on research data from Rajhi Capital.

US Shale Oil- Operating cost per barrel (US$). Source: Rajhi Capital

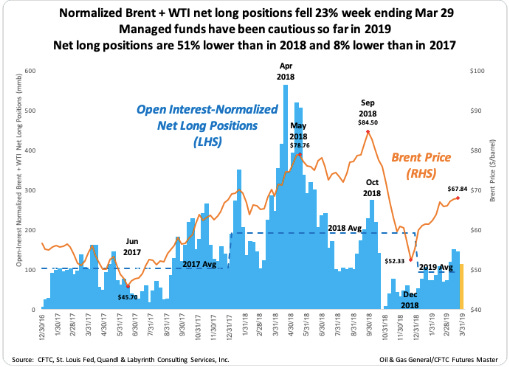

Speculative net long positions remain low compared to 2018.

Net speculative long positions. Source: CFTC, St Louis Fed, Quandl, Labyrinth Consulting services.

Brent Oil Vs OAS. Source: Stockcharts.

In a bear oil market, shorting OAS and being long Brent has been a profitable bet. Oasis operation production cost is around 64 USD!

High Yield Bond Zombies

Noise: Since October 2018, the high-yield market has been under pressure. Following Powell’s recent change of tone, a very strong rally in high-yield bonds has persisted based on the expectation that liquidity will remain favorable for global markets.

High-Yield Bond ETF (HYG) Vs Investment Grade ETF (LQD)

Signal: In comparison to the 2008 financial crisis that was driven by a trust problem in the banking system, we think that the seeds of a new financial crisis is in the bond market. Deterotitation of credit quality and the lack of defaults for more than 10 years could trigger a tightening cycle in the bond market that could be amplified by the ETF industry.

Source: Bloomberg, Macrotourist.

Investment grade debt is all corporate debt that receives a credit rating of BBB or higher.

When the credit rating drops below BBB, it is no longer considered investment grade, and gets reclassified as high-yield or junk bonds.

The most important thing here is that when this occurs, many institutions can no longer invest in the particular security. Therefore, it is very important for companies that rely on this funding to maintain at least a BBB rating.

Possibly the most troublesome thing right now is the fact that the number of issuers holding an investment grade of BBB or higher has never been greater.

Australia Reminiscent of 2008.

Noise: One of the ways to express an optimistic view about the trade deal between China and the US is by being long the Aussie Dollar and Australian stocks.

Signal: There was a very strong outlier that happened in January 2019 when the Australian Dollar (AUD) crashed against the Japanese Yen (JPY). That is a big indicator that something is very wrong in the Australian economy.

Australia is an indirect way to play against the logic of globalization. Australia has been a big beneficiary of China’s rise in many ways.

The ferocious appetite of the Chinese for commodities has boosted Australian exports immensely, and therefore the economy as well.

Chinese buyers have poured billions of dollars into the Australian property market.

However, the rise of China is also a national security concern for Australia. A new definition of the Sino-Australian relationship will impact the Chinese investor’s demand for real estate.

Australian households are over indebted with mortgage loans of 1.7 trillion Australian Dollars ($1.2 trillion), the Reserve Bank of Australia’s capacity to raise rates is limited, meaning that the Australian Dollar will probably continue to weaken.

The big four Australian banks are also the most fragile: WBK, CBA, ANZ, NAB. Their shares continue to underperform the Index.

Australian Equity Index Vs Australian National Bank. Source: Stockcharts

The Australian banking system is noteworthy for the predominance of housing loan assets. Lending for housing has traditionally been safe and profitable and, as a result, has grown to become the largest business line for many Australian banks. Building societies have, of course, always been focused on housing, and over the past couple of decades credit unions have transformed themselves into housing lenders as well. Housing lending now accounts for around 40 percent of banking industry assets, and a little under two-thirds of the aggregate loan portfolio. With such a concentration in a single business line, we are all banking on housing lending remaining ‘as safe as houses’. Australian Prudential Regulation Authority’s (APRA)

Being long the ASX Index while shorting Australian banks seems to be an interesting trade.

Subscribe to our Newsletter

Bogotá, Colombia

Guillermo Valencia A

Head of Global Macro Research